I’ve often found myself wondering what travel insurance to get when renting motorcycles abroad. I carefully read the fine print, but there are many instances where motorcycles aren’t covered. Well, I’m pleased to say that World Nomads does cover motorcycles (under specific circumstances), and I can confirm that claims and payouts are quick and easy.

So here’s my review of World Nomads from a motorcyclist’s experience — when renting motorcycles.

I’ve rented motorcycles in France, Italy, Nicaragua, Kenya, Tanzania, and the US. I usually find a local operator, but in the US I like to go peer-to-peer and rent from Riders Share or Twisted Road.

But one thing that always bugs me is the question of insurance. Riding a motorcycle is risky business. It’s especially risky when riding on a bike I don’t know in a place I haven’t ridden. So I always consider the fact that I might crash the bike and maybe even hurt myself.

In these situations, you might be wondering

- What insurance do you need when you rent a motorcycle?

- What kinds of things should you look for in a policy?

- How hard is it to make a claim?

While it’s hard to research insurance, it’s easy to buy. But then the acid test of insurance is whether the insurance provider actually pays out. So I’m happy to recommend World Nomads, based on my experience of actually making two claims and having them pay out relatively fuss-free, with one instance including a motorcycle incident. You can read my stories below.

I’ll cut to the chase — I recommend World Nomads for renting motorcycles abroad provided it is in your coverage. Get the Explorer plan to cover rental deductibles. I’ve used it and made claims and received payouts, and I know from personal experience that they cover things like motorcycle rental deductibles, hospitalisation, and damage to gear. You still need primary cover, and you need cover from the motorcycle rental company. But World Nomads is da bomb.

(Disclaimer: This is a personal recommendation based on my experience — not financial advice. Read your product disclosure statement to make sure your coverage is sufficient. Your coverage depends on the underwriter, which depends on your country and agreements between World Nomads and local insurers (see this thread on Horizons Unlimited for example). Every product is different. The below is from my experience, but yours may vary. Finally, if you choose to buy through this page, I may receive a commission, and I appreciate your support.)

Also a disclaimer — most insurance policies I’ve checked don’t cover situations like buying a bike abroad or taking your own motorcycle abroad. This is for rentals. The insurance policies specifically require it. So, if you’re travelling around the world by motorcycle, this article isn’t for you.

Are you obsessed with motorcycles?

Well, I am. That’s why I created this site — as an outlet. I love learning and sharing what others might find useful. If you like what you read here, and you’re a fraction as obsessed as I am, you might like to know when I’ve published more. (Check the latest for an idea of what you’ll see.)

What Insurance Cover Should You Have When Riding Motorcycles Abroad?

This question varies depending on where you’re riding. America is very litigious, for example, but other places aren’t.

Consider a worst-case scenario: You crash (and are at fault for crashing) into someone’s McLaren F1. You’re injured, as is the driver of the McLaren. Both vehicles are damaged. Here’s what you need to be covered for:

- Injury to yourself. You need to be able to cover your evacuation, hospitalisation, and maybe medical evacuation to your home country.

- Damage to the motorcycle that you rented.

- Damage to your personal belongings, like your helmet and other gear, plus the GoPro that you had mounted to record your adventure.

- Injury to the other driver. They have whiplash, lacerations, and so on, and may have to miss work during recovery.

- Damage to the other driver’s vehicle.

Are you sweating? This isn’t actually a far-out scenario, by the way. I often rent motorcycles to ride in the hills outside Los Angeles, and I regularly see supercars with values over $100,000 (for the ones I know) flying around, driven by kids. It’s a crazy country. (Here’s an article about driving an Acura NSX out on Angeles Crest Highway, though it sounds like what that person really needs is a car or bike with no electronics.)

In such a scenario, the well-to-do driver of the McLaren F1 may choose to sue you, thinking your insurance will cover it. In the US, this could make you liable for millions.

So what kind of insurance do you need? Let’s have a look:

| Injury | Insurance needed | Provided by |

|---|---|---|

| Injury to yourself | Medical insurance / Personal Injury | * Travel insurance * Domestic primary cover |

| Damage to the motorcycle you rented | Collision insurance | * Motorcycle rental company (via their insurer) * Travel insurance for the deductible |

| Damage to your personal belongings | Personal items damage insurance | * Travel insurance |

| Injury to the other driver | Liability insurance (Bodily injury) | * Rental insurance (state minimum) * Travel insurance |

| Injury to the other driver’s vehicle | Liability insurance (Property) | * Rental insurance (state minimum) * Travel insurance |

If you injure yourself, you need to get evacuated to a hospital and then you have to pay hospital fees. Foreigners usually pay full fees at hospitals. This can be expensive in most parts of the world, but in the US, it can literally bankrupt you. There are plenty of horror stories — just check out a few on Reddit. (Of course, people in financial hardship don’t pay the ludicrous bills. But if you’re a foreigner and you’re billed a “reasonable” sum like $20,000, you might have to pay it, and chalk it up to experience.)

If you damage your motorcycle, then you may need to get it towed back somewhere (itself a big bill — maybe $500 if you’re remote) and then get it repaired. When you rent a motorcycle, you have to get collision insurance. Optionally, you can get towing coverage. For collision insurance, you’re liable for up to the deductible that you chose — e.g. $500 to $2000 or so. But travel insurance can pay that for you.

Now, rental insurance usually doesn’t cover your personal belongings — which can cost a lot! I wear roughly $1,000 worth of gear (give or take), half of it my helmet. Those people who travel with the latest Shoei flip-up touring lid and an Aerostich Roadcrafter would have more. Then there are the cameras and other stuff you have mounted to your motorcycle… all that can (and does) get damaged in a crash, too.

Now on to the last two categories – injury to the other driver and injury to their vehicle.

In places like Europe, Australia, and most of the world, really, healthcare is managed by the government at little to no cost to the end user. So if you hit someone and they get hurt, they’re unlikely to sue you for expensive hospital stays. Similarly, they’re much less likely to make a personal injury claim — the processes for such things are expensive and don’t pay out anywhere near as much as in the US, so things like personal injury lawyers don’t exist in abundance (you won’t see their ads everywhere like you do in the US).

But in the US, you have to be wary of personal injury lawsuits. You need some kind of coverage.

What Insurance Rental Company Insurance Provides

There are two kinds of insurance that rental companies provide (mostly)

- Collision damage, and

- Personal liability

Collision damage is usually up to the value of the motorcycle. There are limits — for example, Riders Share doesn’t cover more than $30,000. Twisted Road covers up to $40,000. But that’s more for the owner to know — don’t put your Desmosedici RR onto Riders Share (sadly). Their insurance plans also cover theft and fire.

Personal liability cover is more limited. When you rent a motorcycle (or car) through a rental company, typically their insurance will include the state minimum third party liability coverage.

For example, in California, the state minimum this includes

- $15,000 for injury/death to one person, or $30,000 for more than one person

- $5,000 for damage to property

Those are, relatively speaking, nothing. If you write off someone’s car, it’s nearly always going to cost more than $5,000 for them to repair it. If you cause injury to them and they sue you, then they’re nearly always going to be seeking much more than $15,000.

Other states have similar minimums, though some are more generous. E.g. New York and Missouri require $25,000 per person ($50,000 per accident) and $25,000 for property. Most states (see this list on Nerdwallet.com) are somewhere between $10-30K. None of them is above $100K.

If you know much about US lawsuits, then you’ll know that insurance payouts can be a lot more than that. So ask yourself — is the mandated state minimum enough? If you’re not sure it is, then you may need additional coverage.

What to Watch Out for in Travel Insurance

There are two main things to watch out for in travel insurance.

Firstly, be wary of whether motorcycles are covered, and if they are, whether there are limits. See below for a couple of examples.

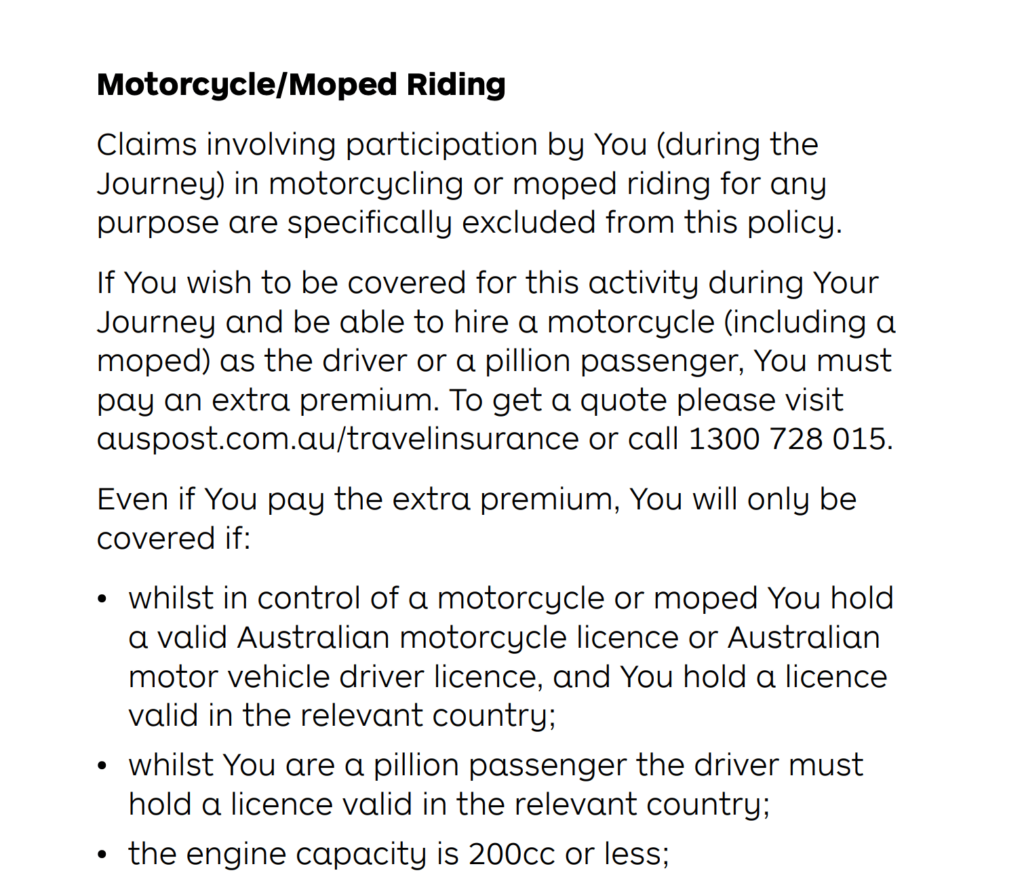

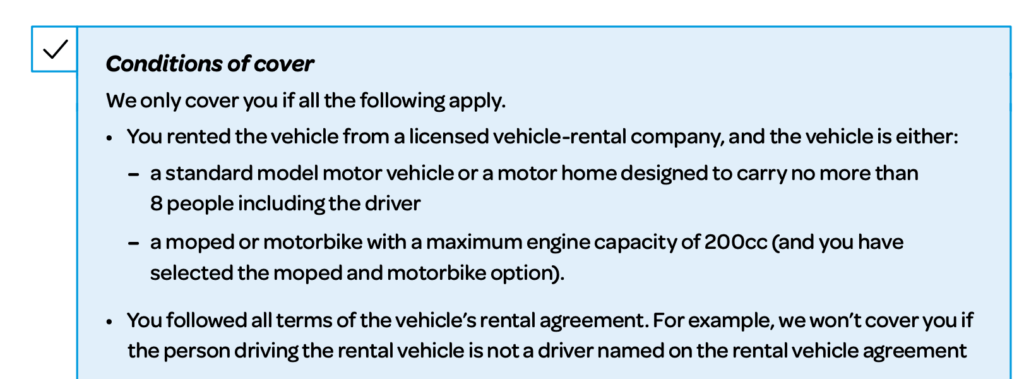

When I read the fine print of many insurance policies, they often specifically exclude claims related to motorcycles or even scooters.

And then when policies do cover them, the policies usually only cover small vehicles — e.g. up to 200 cc in one instance.

Some policies do cover motorcycle incidents, and even those over 200 cc. But you may have to purchase the “adventure pack” to be covered. This is the partially case with World Nomads — motorcycling is covered, but you need the “explorer” plan to cover the rental deduction for any vehicle.

Secondly, be aware that coverage doesn’t mean that it’ll be easy to make a claim.

I have various kinds of insurance with my credit card. But I’ve never successfully made a claim. They ask me for more paperwork than I have, and eventually, I’ve given up. This is a common tactic by lower-cost insurers.

Note that giving someone the paperwork runaround is actually illegal in most modern jurisdictions. But my reality is that I didn’t have time to chase up paperwork due to work and life commitments, and so I also didn’t have time to chase up a claim against them for behaving that way. I know this happens to others, too.

What World Nomads Insurance Provides

Here are the most important things that World Nomads provides in its insurance. Again, this is my insurance policy I’ve had with them — but it’s not unusual.

| Item | Standard plan, single | Explorer plan, single |

|---|---|---|

| Rental vehicle insurance deductible | Not included | $3,000 |

| Accidental damage to personal items | $2,000 | $10,000 |

| Personal liability | $1,000,000 | $2,500,000 |

Primarily, renters get insurance for damage to the vehicle from the rental company.

When renting a motorcycle, I’m always confronted with the question of what level of insurance cover do I get. Do I save a few quid and get the one with the $2000 or 2000 Euro deductible (which some people call “excess”), or do I spend a lot and get zero deductible / zero excess?

There’s rarely an option to get no insurance. Not that I’d take it. Riding a motorcycle in a foreign environment, like the time I rode a Monster 821 around the hills of northern Italy, meant a new bike in a new place. I’m not some rally rider, so I know I’m fallible. I’ve crashed before, and I’ll crash again. It’s how you learn.

World Nomads then covers the gap between your deductible if you make a claim. That means that in theory, when renting a vehicle, you can opt for the biggest deductible, because you know that your travel insurance will cover the rest. (I know it’s tempting to max out on all kinds of insurance just to be safe, mind you.)

On top of that, you get coverage for

- Damage to personal items in a crash, and

- Personal liability, in the event that you’re liable for injury or damage to someone else.

I haven’t tested the personal liability part of it. But I’m glad it’s there, just in case.

Conditions of Insurance

Naturally, you need to meet various conditions to be able to make an insurance claim.

These involve the usual “you’re doing the right thing” aspects, like

- You’re the one riding the bike (you didn’t lend it to a friend)

- You have the appropriate license

- You’re not doing anything illegal (this includes speeding, presumably)

Importantly, World Nomads insurance covers rentals. On top of that, you have to have renters insurance to be able to claim with World Nomads. They don’t replace that.

Finally, like all travel insurance, you do have to have primary insurance somewhere. As an Australian, I’m covered by my country’s health care system. If I need long-term recovery treatment, then World Nomads might fly me home once they’re sure I can fly.

If you’re from a place in the world where you have to pay for your own health insurance, like in the US, make sure you have it, or your travel insurance might not work.

My Experiences Making Claims with World Nomads

I’ve made claims twice with World Nomads. One was for a general illness, and one was with a motorcycle crash.

Here are my stories.

Experience 1: At Death’s Door in Beijing, China

The first time was around a decade ago. I was in China, where I was doing a project. I had a cold and was taking painkillers that I got from home. When I got to Beijing, I had to go to work (I was working at a tech company that used to be kind of a big deal but which now nobody remembers), but still had cold symptoms, so I got some cold and flu medicine from the pharmacy to alleviate the runny nose and sore throat.

That’s where my problems started. My symptoms went away, but I started to feel weak. I went to the bathroom and long story short, I thought “I must be super dehydrated.” Then, in a meeting, I remember talking to everyone when one of my colleagues suddenly said: “Dana, why are your eyes yellow?”

I went home, still feeling ill, not sure what to do. I checked with World Nomads and they said to just go to the nearest hospital and keep all the receipts and they’d take care of it. So I tried to sleep it off (waking up feeling worse than ever — like I was dying), and headed straight for the best hospital around, Beijing Family United, where the staff were all trained all over the world and generally held teaching positions in China’s most prestigious university, Peking University.

They did tests on me. I can’t remember which ones, but they involved equipment. Those didn’t show anything immediately. They told me that I either had cancer, hepatitis, or something else. It sounded bad.

Then the head of internal medicine asked me a question: “Have you had a cold lately?” I answered that I had. “And have you been taking any medicine for it?” Yes, I had…

Long story short, by doubling up on painkillers and cold and flu medicine, I had accidentally overdosed on paracetamol (which Americans known through the brand Tylenol, and which Europeans sometimes call acetaminophen). Read about paracetamol poisoning here. The Chinese drugs had paracetamol, and so did the ones I had from home, which meant I was taking double the recommended dose. This caused acute liver failure. Another day or so and I’d have died.

The doctor gave me medicine to clear it up, which it did, and I’m here.

On the insurance part — on the way out, I paid a hefty $1,600 on my credit card and got itemized bills. I took photos of it all, emailed it to World Nomads, and within a week had a $1,500 refund — the entire amount, minus the $100 deductible.

Experience 2: Riding Motorcycles in the US

The second time I made a claim with World Nomads was more recently, and it’s why I decided to decided to write this article, because it involved motorcycles.

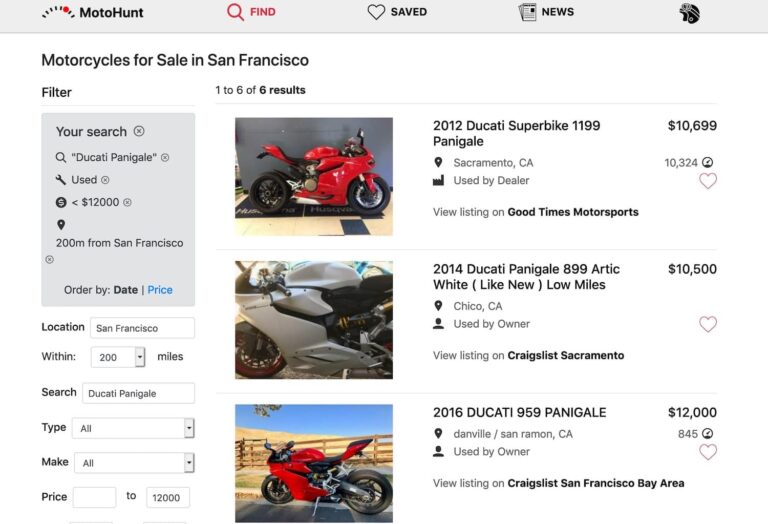

I was riding a rented motorcycle in the ACH. It was a Harley-Davidson VRSCDX Night Rod Special, a bike I’ve had a crush on forever, even though I didn’t really enjoy it at the end of the day (cool engine, but I was fighting the chassis and riding position the whole time). Here’s my riding experience — minus the bummer of the crash at the end!

Around 10 miles before the end of my ride route, I had a mishap. I was going around a corner quite slowly — around 10 mph (I was taking it easy as I was getting tired, and it was a difficult bike to take around those corners) when suddenly the front wheel slipped and I lost control. I’m still not sure what happened, except that there was gravel and rocks around. It’s likely I slipped on something like that.

The bike landed dramatically on its side, as did I. I had almost no injuries other than a bruised hip. Classic, the only part of me that wasn’t wearing bike gear (my bike pants were still in the mail!) was injured.

The bike only had minor damage, but we knew it’d be written off, because the frame was damaged. The footpeg is welded to the frame, so it doesn’t take much to damage the frame.

I reported it to Riders Share, took the bike back to the owner, and started assembling paperwork.

First, the good news. The owner, who was quite a champ for the way he took this in his stride, was paid out within days. I don’t know the details of owner’s insurance under Riders Share, but I understand he was paid a sum that was in line with other similar motorcycles listed in his area.

Secondly, my claim. I claimed the deductible, plus damage to all my gear (including my $500+ action camera), and World Nomads accepted it all. I had receipts and photos of the damage. Now, I made one mistake — I didn’t choose the Explorer plan, so I didn’t get paid out my insurance deductible, so I lost out on another $1000. But World Nomads said I would have, had I chosen the Explorer plan.

All in all, I’m pretty happy with the outcome. And I know to get the Explorer plan next time.

Wrap up

Insurance is painfully expensive. But for me, especially when riding in a place like America where medical and legal costs can balloon, it’s worth having.

There are possibly other insurance providers that can provide similarly positive experiences. But since I’ve found it easy to use World Nomads, I also find it easy to recommend them!

If you have other similar experiences, I’d like to hear them.