Have you ever come across a deal that seems too good to be true? One where you love the bike but can’t afford it (or have no space for it), but which is priced so low that you can’t say no?

Recently, I found a motorcycle that was a really good deal — good enough for me to overlook the fact that there was a little paperwork to go through.

The complication in this good deal was that the motorcycle had an unpaid loan on it. In Australia, this means that there’s a lien (a.k.a an encumbrance) recorded against the vehicle and that the bank can reclaim it.

In many other parts of the world (e.g. the US), the bank holds on to the title until a debt is cleared. Once the loan has been repaid, they sign the title over to the owner. (This whole complicated process of paperwork management is one reason why I think this needs to move to the blockchain.)

Regardless of how the paperwork is managed, you can absolutely buy a motorcycle that has a lien or unpaid loan on it. But there are a few things you should know that will make buying a motorcycle with an encumbrance a smoother process.

Are you obsessed with motorcycles?

Well, I am. That’s why I created this site — as an outlet. I love learning and sharing what others might find useful. If you like what you read here, and you’re a fraction as obsessed as I am, you might like to know when I’ve published more. (Check the latest for an idea of what you’ll see.)

Background — Why Buy a Motorcycle With an Encumbrance/Lien?

A common reason for which people sell bikes is that their life situation has changed considerably. Maybe they bought an expensive motorcycle, then had bills to pay or their work situation changes, and they can’t afford to make the loan repayments.

In these situations, people are often a little more motivated to sell, and so price a motorcycle low… but of course, that low price comes with some procedural complications. You have to help them pay off the loan. And without selling the bike, the seller has no means to.

I looked at this motorcycle, a 2016 Suzuki Hayabusa “Special Edition” (fancy paint and standard Yoshimura exhausts outside the US), because I decided I missed my ‘Busa I had sold six months prior and wanted to get another one.

Initially, the buyer’s asking price was what I considered reasonable. But I passed for practical reasons — I was planning a big trip abroad and the bike would just sit in storage for a long time. It was only because the seller lowered the asking price a lot that I decided to bite the bullet.

The motorcycle was in a city about 1200 km (800 mi) away. So I couldn’t do an inspection. On top of that, the ride back was boring and via another state, so a fly-and-ride was impractical. So I decided to do the whole thing (inspection, negotiation, and payment) remotely, and to organise transport.

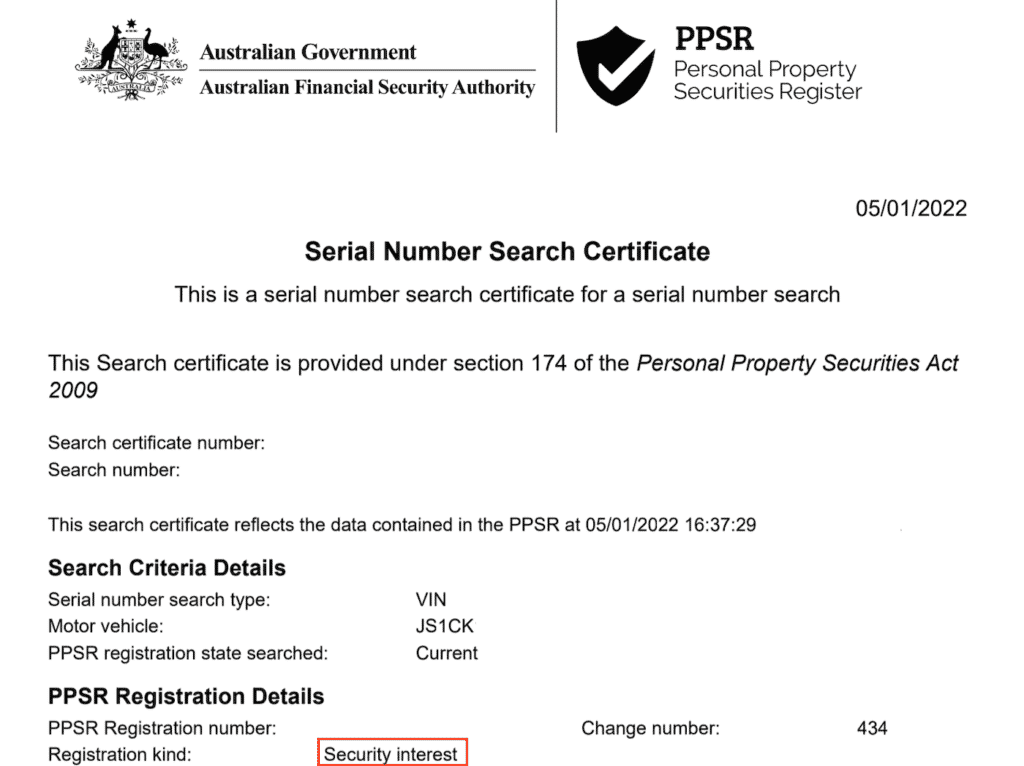

I made sure to do my inspection checklist remotely, looking over the usual suspects where I often find something (in the tank, on the forks, etc.). I didn’t find anything physical — but when I checked the paperwork, that’s when I found out there was a security interest.

How I found out about the encumbrance

The first item on my inspection checklist is to do a title check. That’s how I found about the encumbrance.

It’s important to do a title check on any vehicle you’re buying because you have to make sure that the vehicle you’re buying actually belongs to the buyer, isn’t reported lost or stolen, has never been written off, and isn’t the security on a loan.

I found out through the title check that the loan had an encumbrance on it — meaning there was a loan he hadn’t paid off, and couldn’t pay off until I had bought the bike.

In most parts of the world, you can do a title check either for free or by paying a tiny fee. In the US, you want a bike with a clear title. A clear title means that there are no outstanding loans, and that the bike is not written off or salvage title. There may be a salvage title, but the seller must have disclosed it and priced the bike appropriately.

In Australia, you want to ensure that the bike has no outstanding loans, is not reported stolen or lost, and also is not on the WOVR (Written Off Vehicle register). You do this by checking the personal property and securities register, or PPSR.

Here are the official sites:

- Australia: https://www.ppsr.gov.au/ (note the .gov.au) — it costs $2

- USA: https://vehiclehistory.bja.ojp.gov/ (that site links to a bunch of other sites, and you may end up paying money through those…)

Because of the security on the bike, if I bought the bike, I wouldn’t be the beneficial owner. If the seller defaulted on the loan, the bank could seize the motorcycle. If they couldn’t find it, they could declare it lost/stolen, and I’d then own a lost or stolen bike.

So, what to do?

Three ways of dealing with an encumbrance (a motorcycle with an outstanding loan)

If you want to buy a motorcycle with an outstanding loan on it, there are three ways of dealing with it.

- Ask the seller to pay it off

- Pay it off with the seller on the day of purchase

- Pay the bank directly yourself, as a deposit

Ask the seller to pay off the loan

The first, and best way of dealing with an encumbrance, is to ask the seller to pay it off.

Your goal is for a motorcycle previously with an encumbrance to have a clean title before you pick it up. Then you pay them the full asking price and have the title assigned to you (in the US, where it’s signed over on paper). In Australia, this would mean registering it in your name.

This works only if the seller has enough money to pay off the bike. The problem is that this is not always the case, and that’s the reason they’re selling off the bike.

Nonetheless, for many people, this is the only way to buy a bike from someone — particularly if you’re doing it remotely.

The complication with this is that it takes time. For the title to become clear, the following has to happen:

- The seller has to wire the money

- The bank has to receive the money (can take a business day)

- The bank has to process the loan paperwork

- The bank has to notify relevant authorities that there’s no more security interest on the bike and/or sign over the title to the seller

All of those take time — I’d budget a week. In that time, someone else may swoop in with a better offer on the bike.

Go to the bank with the seller and pay off the loan

A second and common way of dealing with the encumbrance is to go with the seller to the bank to pay off the loan. Then if there’s any balance, you give it to the seller, and pick up the bike.

You may also opt to write a check (or “cheque”) to the bank and give it to the seller, asking them to take care of the paperwork. Checks make me feel a little nervous — but if you trust the seller, this can work.

If you’re in the US, the bank should sign over the title once the loan is paid off.

In Australia, you can do this too. But banks have different processing times for loans. The PPSR system has to clear for you to register it, and that might be that day or a day or two later.

But at a very minimum, the bank should give you a letter stating it no longer holds any security interest in the motorcycle. The letter saying there’s no security interest is enough for you to feel secure.

Pay the bank directly

Finally, you might choose to pay the bank directly yourself. Get a statement from the buyer’s bank with details of the loan, and pay it off directly using the payment instructions.

You then have to wait for the payment to clear and that might take a day for them to receive the money, then another day or two for an employee to find it in the system. I’d only use this method if you really trust the buyer.

That’s the method I chose. I paid off the outstanding loan balance (less than $3000), and effectively was giving the buyer a $3000 deposit. Pretty huge! But he seemed like a nice guy, and I thought it was worth the risk.

I did mentally say goodbye to that $3000 though, knowing there was a chance he could abscond.

How to protect yourself when buying a motorcycle with an encumbrance / lien

If you’re giving deposits or paying off someone’s outstanding loan before pickup, you want to cover your backside. Basically, mitigate risk as much as possible.

The four things that are most important are

- Keep a full paper trail — ID documents, receipts, transfer records

- Make sure the numbers match up.

- Don’t pick up the motorcycle until it has either a clear title or you have a letter from the seller’s bank

- Make sure you trust the seller

Keep a paper trail

The best way to protect yourself is with a paper trail. You don’t need to be a lawyer, but make sure you have a really clear set of documents that show

- The full names and details of the buyer and seller, with proper identification

- Registration information (VIN, license etc.)

- Photos and copies of ads

- Evidence of money transfer

Think of it like this: police show up on your door and claim you’ve stolen the bike. How can you prove you didn’t?

Or the bank might claim they have a right to it. That’s trickier, but you still want to suggest they should be going after the original owner — or at least have documentation to then pursue the original owner.

The answer to both situations is: Collect all the evidence you can, ready to be used to prove that you’re the rightful owner.

You don’t have to run away from a procedurally complex situation. In fact, those are sometimes the best deals. But also don’t be shy about getting information to protect yourself. It’s like counting money when someone hands it to you to buy something — it’s not rude, it’s just basic business.

Make sure all the numbers match up

It’s easy to get lost in the details of a motorcycle purchase. But that means that there are lots of ways that a seller can rip off a potential buyer.

The basic rule of thumb is: Make sure everything is kosher and that you’re comfortable with it. If you’re not, just don’t move forward.

In detail, some of the checks I’ve done are to make sure

- The VIN stamp matches the VIN on the registration paperwork and on the loan documents

- The model of the motorcycle is the same everywhere

- The bank wire transfer information is what they officially publish on their website

- The letters/emails that the seller provides to you from the bank are complete (not just a partial screenshot)

- The loan balance matches what the seller told you (e.g. the seller told me “There are about five payments left of $500 each”, and then the loan paperwork showed about $2500 remaining).

Pretty quickly you can get a feeling for whether the person you’re buying from is trustworthy or not. You can trust your judgment.

There’s no harm in calling things off. There are always other bikes.

Make sure the title is clear (or that it will be)

Ideally, you should only buy a bike with a clear title. But in the event that you do something slightly risky like I did, a paper trail should help you cover your backside.

For example, I thought there was a chance the seller would never deliver the bike after I wired $3K or so to pay off his loans. In that case, I’d have to go to a small claims court and the police, and I’d want to present them with as much information as possible about the seller. I might have gotten it back that way. It’d have been an annoying process, of course.

In the case that the bike doesn’t have a clear title, I’d ensure you both a) trust the seller, and b) have a letter from the bank saying the loan has been paid off.

Make sure you trust the seller

Finally, make sure you trust the seller. This is subjective, but basically, do your diligence. If you think you see eye to eye with the seller and they won’t screw you over, then you can buy the bike.

In my case, I spoke to him on the phone, checked his social post history (we shared some groups), and googled what I could (that didn’t come up with much).

If someone were to google me, of course, they’d find I’m all over the internet, being an online business person. I envy people who have to do diligence on me, oddly!

Some signs of an unscrupulous seller are:

- They don’t disclose something they should have very early — like that the bike was written off

- The bike is in very different condition to advertised

- They’re vague on important details like service history. Or if the details change…

Don’t judge people by appearances, though. I’ve had great transactions with people who earlier in life I’d have been scared of. Nowadays, I meet people covered in tattoos and one and a half times my size and assume they’ll be respectful, honest, cheerful, and just great folk.

I tend to pick hobbies/obsessions that bring many people together. Prepare to be surprised!

Aftermath — How did it go?

Well, everything went well. Luckily, I admit!

The first thing that went well was that the seller was cooperative.

I didn’t get an inspection done, but I did do a video inspection, looking at the things that are the usual suspects — tyre tread, chain and sprockets, rust in the tank, and leaky fork seals. All was kosher.

One other thing I did was to enlist a transport guy (Tony WIlson of Five Star Motorcycle Movers) who is both a bike lover and a Hayabusa obsessive. He told me he’d look over it — just casually, but I knew he’d be attentive.

When his assessment came back as “If you don’t want it, I’ll keep it!” I knew I was golden.

I had the bike delivered to a mechanic who also gave it a once over. They took out a bit of oil (it was overfilled) and fitted a new front tyre, which was expected.

I still haven’t registered it, but I will soon. Or I might just keep it as a track bike. But it’s a little too pretty…